But it is scary and would put a lot of traders out of business,” he said. “I would hope that this would not get through the House, and I would hope that this would not get approved. Dick said these taxes could end up being more expensive for traders than the trading commissions that most online brokers recently eliminated.

See Also: Here's How Much A 24-Hour Internet Blackout Would Cost The US Economyĭick said even the conservative 0.1% tax rate would mean each $10,000 trade would come with a $10 tax bill. But if you trade stocks, and they put a financial transaction tax in, this is directly going to impact you.” “If you’re a trader, you have to think twice about voting Democrat right now.

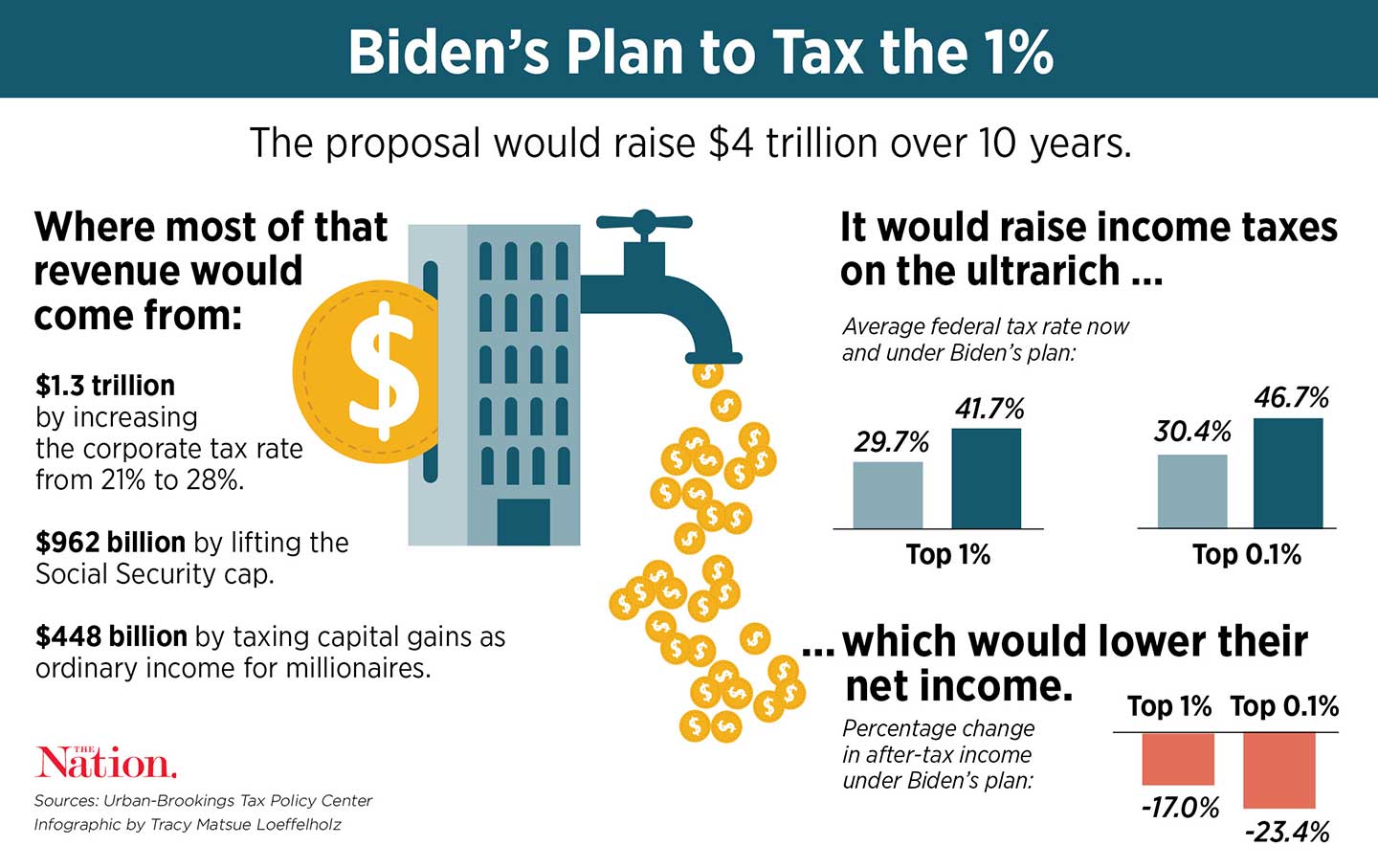

“This financial transaction tax is still scaring the hell out of me,” Dick said. On Friday’s PreMarket Prep, co-host Dennis Dick said these new financial transaction taxes would be bad news for the average trader. This week, Biden said he would support new taxes on financial transactions. Sanders is proposing an even more aggressive 0.5% tax on stock trades 0.1% tax on bond trades and 0.005% tax on derivative trades. Warren has said her 0.1% tax on sales of stocks, bonds and derivatives could raise $800 billion in revenue over a decade. While candidates argue these new taxes could help pay for ambitious healthcare programs that could benefit the middle class, critics say they would suffocate retail stock traders. Democratic presidential candidates, including Joe Biden, Elizabeth Warren and Bernie Sanders, have proposed a new tax on financial transactions.

0 kommentar(er)

0 kommentar(er)